본문

The Timing of Cooperation between Upstream and Downstream Partners in New Product Development Processes

by Prof. Jongkuk Lee (jongkuk@ewha.ac.kr )

Department of Business Administration

Firms often involve downstream firms in their new product development (NPD), and downstream firms play active roles in the codevelopment. Upstream firms are those that produce technologies or products for the use downstream in the value chain; downstream firms apply or commercialize these technologies or products to serve their customers. For example, in the collaboration between biotech and pharmaceutical firms, biotech firms act as upstream partners that provide technological breakthroughs to pharmaceutical firms, which then act as downstream partners by developing and introducing specific applications of those technologies. Codevelopment between upstream and downstream partners represents an innovation strategy to gain external knowledge inputs that can widen the pipeline of new products, rather than each partner handling the entire NPD life cycle internally.

Codevelopment occurs at varying stages of the NPD process: early stages includes discovery and basic research to seek new knowledge, and late stages include the appropriation of current knowledge to develop and commercialize specific applications. For example, Xenon, a clinical, genetics-based drug discovery and development company, initiated an early-stage agreement with Merck to discover and develop small molecule candidates to treat cardiovascular diseases. For Xenon, this codevelopment agreement served as a risk mitigation strategy in its early stages; it gave Merck the opportunity to license exclusive targets and compounds from Xenon for its own development and commercialization. In contrast, Dynavax Technologies, a biopharmaceutical company, entered a collaboration agreement with Merck to develop an experimental hepatitis B vaccine in late-stage clinical trials. For Dynavax, this late-stage codevelopment offered an opportunity to commercialize its new products while retaining its claims on the new product; it also gave Merck the opportunity to add this new product to its line without suffering the risk of early-stage NPD processes.

We investigate the performance impacts of such decisions for upstream and downstream partners, so this study addresses the firm value that results from codevelopment initiated at different stages of the NPD process. New product opportunities tend to be temporary and uncertain in competitive market environments, and firms have trouble in choosing the best codevelopment timing. In particular, codevelopment during the NPD process involves varying degrees of product specificity and performance uncertainty, two key sources of transaction costs (TCs). Codevelopment initiated at earlier stages involves higher product specificity, in that the downstream partner participates in and affects the upstream partner’s new product decisions from the very beginning of the process. It also entails greater performance uncertainty, associated with extensive searches for the creation of new knowledge at early stages. We advance a contingency model in which the outcomes a firm enjoys from codevelopment depend on how partners cope with and how different market situations alter the transaction costs.

Transaction Costs During Customer Codevelopment

| TC Source During Customer Codevelopment | ||

| Product specificity | Performance uncertainty | |

| TCs to upstream firms |

Early-stage codevelopment increases TCs of upstream firms associated with product specificity, such as hold-up or haggling caused by early lock-in. | Early-stage codevelopment reduces TCs of upstream firms by providing new inputs and endorsement for the upstream firm to overcome its performance uncertainty. |

| TCs to downstream firms |

Early-stage codevelopment reduces TCs of downstream firms by increasing the specificity of the products to serve their needs. | Early-stage codevelopment increases TCs of downstream firms by exposing them to early-stage performance uncertainty. |

We applied an event study methodology and analyzed 276 codevelopment agreements between biotech and pharmaceutical firms during 1998–2010. We find that equity governance, technological capability, and market competitiveness drive codevelopment to generate inconsistent returns for the upstream and downstream partners. In particular, when equity governance is in place, the upstream partner gains more returns from early- than late-stage codevelopment, whereas the downstream partner gains more from late-stage codevelopment. Conversely, if the upstream partner’s technological capability is high or downstream market environment is competitive, the upstream partner gains more returns from late- than early-stage codevelopment, whereas the downstream partner gains more from early-stage codevelopment.

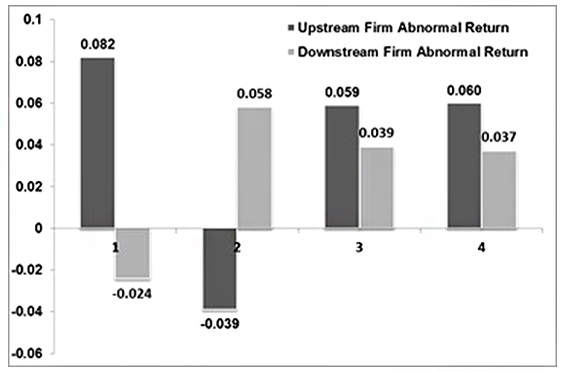

A scenario analysis further shows how to structure codevelopment agreements to align the two firms’ payoffs. We found that appropriate alignments of the contingency factors can generate positive returns (win–win outcomes) for both parties, though this solution would not be optimal for each party, without considering the partner. In Scenarios 1 and 2, consistent with our theorizing, returns for partners are asymmetric when the early-stage codevelopment is aligned with conditions that address transaction costs or magnify the benefits of one partner. Although these scenarios are optimal for one party to maximize its returns, asymmetric returns will make these codevelopment arrangements less sustainable. In contrast, Scenarios 3 and 4 show positive returns for both upstream and downstream partners; that is, though these strategies are suboptimal for each party’s returns, they provide a compromise that contributes to the returns of both parties.

Scenario Analysis for the Alignment of Upstream and Downstream Partner’s Returns

Notes:

Scenario 1: Early stage, equity governance, low upstream partner technological capability, and low downstream market competitiveness.

Scenario 2: Early stage, nonequity governance, high upstream partner technological capability, and high downstream market competitiveness.

Scenario 3: Early-stage, equity governance, high upstream partner technological capability, and low downstream market competitiveness.

Scenario 4: Late-stage, nonequity governance, low upstream partner technological capability, and high downstream market competitiveness.

The findings contribute to several streams of literature. First, we explore when to engage downstream partners during the NPD process to enhance returns on codevelopment. Whereas prior codevelopment research has regarded it as a joint value creation process that pools complementary resources, this study draws attention to different transaction costs that upstream and downstream partners face during their codevelopment throughout the NPD process. Second, this study is among the first to examine the returns to both upstream and downstream partners, which is important because successful codevelopment requires cooperation from both parties. Inconsistent returns to these parties highlight the need for a dyadic approach that considers each party’s specific roles and respective concerns. Third, this study suggests a systematic method to align codevelopment stage with governance, capability, and market competitiveness, leading to a compromise that can ensure returns to both parties in codevelopment alliances.

* Related Article

The timing of codevelopment alliances in new product development processes: Returns for upstream and downstream partners, Journal of Marketing, January 2015, 79, 64-82.